We provided an update on Falco’s financial performance in the first newsletter and some members have since asked if we could provide further detail.

Importantly we are pleased to report that we have just reached a significant milestone with just under 50% of Brendan’s deferred consideration now having been repaid from profit and cashflows. If we continue to generate sales and profits in line with our forecast all deferred consideration due to him will be repaid during the year ending March 2026.

In the earlier newsletter we tried to make it clear that trading performance for Falco in the first 6 months of 2022 had been challenging. Although sales and revenue from the new UKPN frameworks had increased in line with expectation, early deployment costs, significant “uncontrolled” damage charges to old and temporary vans coupled with all the inflationary pressure we have been seeing on fuel and wages etc meant that profit margins fell sharply and profits were well below forecast.

We are pleased to report that through a combination of a negotiated increase in margins with UKPN and a fall in some major costs particularly fuel, mean that gross profit margins over the last few months have recovered well, albeit that we remain below what we had budgeted and historically achieved. This improvement in performance has allowed us to consider setting aside a pot of money to make another distribution to eligible employees. The final number will be decided upon once we see the year end accounts but we are hoping to make individual payments that are at least in line with what was paid in December 2021 and June 2022. These remain discretionary awards and do not form part of your contractual terms with Falco. Any payments would be made with June salaries.

We can’t stress enough, as per individual letters issued by Brendan in June 2022; “any future payments will be made based on demonstrable evidence of greater embedding of employee ownership” not purely based on profits…

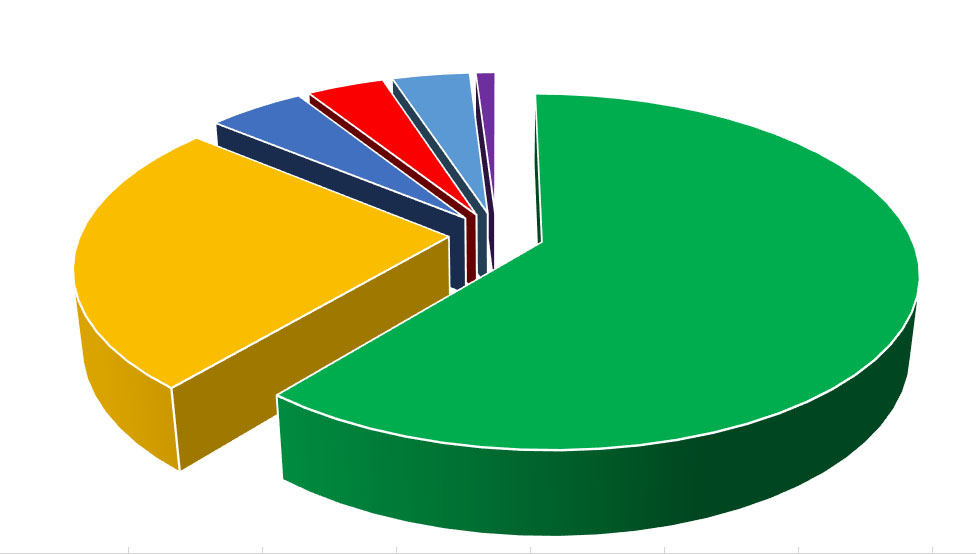

UKPN remains by far Falco’s largest customer. The main UKPN frameworks are of course not due to be retendered until early 2026 at the earliest but it does make us vulnerable should the contract ever be lost. Strategically generating additional revenue from new frameworks and, of course, ensuring that we continue to have a strong a relationship as possible with UKPN are both key to our continued success.